March 9, 2026

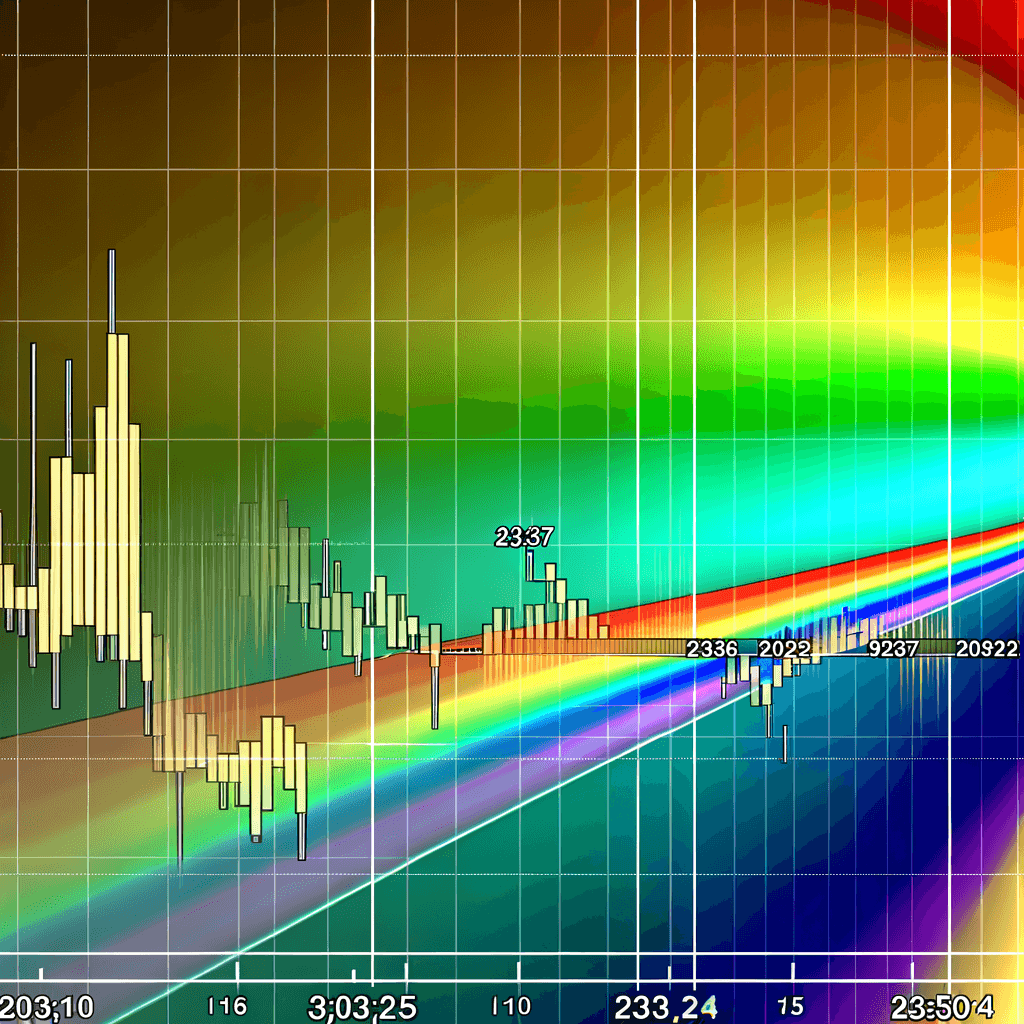

Bitcoin Gökkuşağı Grafiği, BTC fiyatını 31 Mart 2026 için tahmin ediyor

March 6, 2026

Google, Yeni İstismar Kiti Aracılığıyla Eski İPhone'ları Hedefleyen Kripto Dolandırıcılıkları Konusunda Uyarıyor - Haber Kroniği

March 2, 2026

Ripple CTO Emekli 40,000 ETH Satışını Hatırlıyor - U.Today

February 27, 2026

Senato komitesi, yasal kripto ticaretinin önünü açan taslak yasayı onayladı

February 23, 2026

Robinhood Hissesi Dalgalı Oldu. Sırada Ne İzleyeceğimi İşte Burada. | The Motley Fool